Tech-trends

Amazon slapped With $2.5B Penalty for Deceptive Prime Sign-Ups

The Federal Trade Commission (FTC) has reached a $2.5 billion settlement with Amazon over what it calls “deceptive” Prime subscription practices. Of that amount, $1.5 billion will be set aside for refunds to millions of customers who were either signed up for Prime without their consent or found it nearly impossible to cancel, according to…

Apple in the Big Shift: iPhone 17 Production Moves to India

For almost ten years, Apple has been looking for ways to reduce its heavy reliance on China for iPhone production. Now, with the launch of the iPhone 17, the company is making its boldest move yet. According to Bloomberg, all four iPhone 17 models — including the premium Pro versions — will be manufactured in…

Mastercard Advances AI-Powered Payments with New Tools & Collaborations

Mastercard is partnering with AI and commerce leaders, including Stripe, Google, and Ant International’s Antom, to enable secure, scalable agentic transactions for digital merchants and platforms worldwide. The company is advancing AI-driven payments by offering new developer tools, expanding consulting services, and fostering collaborations within the global tech and finance communities. All U.S. Mastercard cardholders…

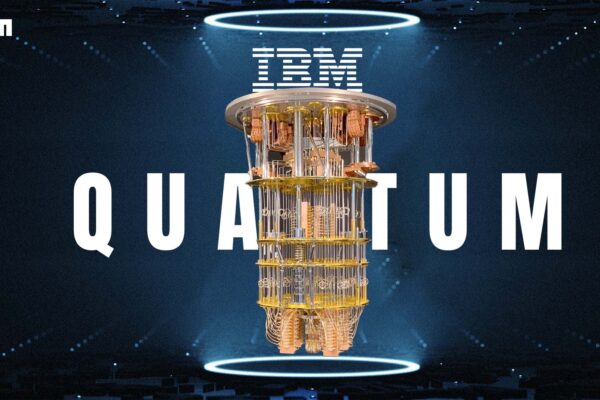

IBM to build Fault-Tolerant Quantum Computer in the year 2029

IBM Aims to Launch Powerful Quantum Computer by 2029 — Sooner Than Expected IBM has just shared an ambitious plan: it wants to build and launch a large-scale, fault-tolerant quantum computer called IBM Quantum Starling by 2029. This is much sooner than many experts thought possible. If successful, this computer will be incredibly powerful —…

Tech Giants Unveil Innovative Solution to Shape the Future of Connectivity

In response to the growing need for customizable and affordable connectivity, Cisco and NTT DATA have teamed up to enhance wireless connectivity for global enterprises, offering a unified solution supported by the robust services of both companies. Traditionally, landlines have been the primary method for connecting business spaces. However, with the advent of eSIM technology,…

How Fintech is Changing: Insights from Clinton Leask of Pay@

In today’s fast-paced world, brands understand that every touchpoint in the consumer journey is crucial—especially in the payment process. This has never been more evident as consumers expect more convenience and personalization at every step. As 21st-century shoppers, we are truly spoiled for choice. Offering a range of optimized, personalized, and integrated payment solutions to…

If AI is the Future of Business, Why Are So Many Struggling to Harness Its Power?

Generative AI: The Spotlight of Innovation Generative AI has emerged as one of the most transformative technological advancements in recent years. However, two pressing questions arise: why is it gaining such widespread attention now when companies like AWS and Synthesis Software Technologies have been using it for years? And why do so many businesses struggle…

Fraud| why Shared Intelligence is the Key to Staying Ahead

According to the latest Global State of Fraud Report from LexisNexis® Risk Solutions, banks and online retailers can significantly improve their ability to detect hard-to-identify, high-risk fraud by integrating shared fraud intelligence into their risk assessment processes. The report emphasizes how collaborative digital identity intelligence can help businesses build stronger digital trust and proactively prevent…

Switzerland debuts ePost encrypted platform in a digital world

Switzerland’s national postal service, Swiss Post, aims to attract one million residents to its ePost encrypted communication platform by the end of 2025. Facing a steady decline in demand for traditional mail, Swiss Post is positioning ePost as a comprehensive mobile app to bridge the gap left by reduced postal usage. ePost aspires to become…

US watchdog issues final rule to supervise Big Tech payments

by shadjava Tech companies like Apple, Google, and PayPal, along with other digital payment services that handle over 13 billion financial transactions annually, will now face government oversight, according to a new rule from the U.S. Consumer Financial Protection Bureau (CFPB). Announced on Thursday, the rule subjects digital wallets and payment apps to the same…