According to the latest Global State of Fraud Report from LexisNexis® Risk Solutions, banks and online retailers can significantly improve their ability to detect hard-to-identify, high-risk fraud by integrating shared fraud intelligence into their risk assessment processes.

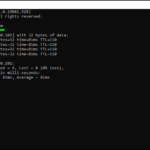

The report emphasizes how collaborative digital identity intelligence can help businesses build stronger digital trust and proactively prevent fraud. It highlights success stories, such as one company that increased its customer recognition rate to 94%, and another that improved its fraud capture rate by 26% by integrating digital identity and email intelligence. Additionally, the report examines the impact of criminal activity on consumer trust, noting that fewer than 10% of mules identified by law enforcement are arrested, and fewer than 1% are charged. The rapid adoption of AI-powered technology by fraudsters, such as automated phishing and deepfakes, is also making scams more efficient and convincing, eroding consumer confidence in digital services. Global fraud attacks have increased by 19% year on year, according to data from the LexisNexis® Digital Identity Network® platform.

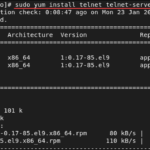

By participating in a shared collaborative network, organizations can flag suspicious activity and confirmed fraud events, making it more difficult for fraudsters to operate. This includes data on the device being used, IP addresses, digital signals, and email addresses. Analyzing these signals to assess potential risk can dramatically enhance an organization’s ability to capture high-risk transactions. For example, one major global bank improved its detection capabilities by 17-fold (1700%), while a card issuer increased its risk assessment accuracy by a factor of 23 (2300%), both through the use of collaborative data.

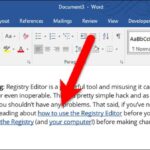

Despite these successes, only 60% of organizations have implemented technological fraud prevention solutions across all transaction channels. Furthermore, just 27% of organizations in the EMEA and APAC regions use consortia or data exchange initiatives as part of their fraud prevention efforts. This is in contrast to the 72% of companies that consider integrating digital experience and fraud prevention efforts as a critical priority, and the 68% who prioritize minimizing customer friction during checkout.

“Consumers’ demand for faster, instant services is driving the creation of alternative payment solutions. In response, regulators and central banks are enabling systems like instant payment rails, which make transactions easier,” said Stephen Topliss, vice president of fraud and identity at LexisNexis Risk Solutions.

“However, every attempt to make transactions easier for consumers also makes it easier for fraudsters. The demand for convenience has put financial institutions in a difficult position, trying to balance technological innovation and convenience with maintaining trust and system integrity.”

The report also delves into the challenge of synthetic identities—fraudulent digital profiles created for illegal purposes. Robust intelligence can reveal red flags, such as the fact that synthetic identities are seven times more likely to have no first-degree relatives and 20 times more likely to appear in multiple credit applications within a short period. It also highlights the role of money mules—around 40% of whom are typically under 25—in helping cybercriminals launder 2-5% of global GDP each year.

Topliss concluded, “The worst-case scenario is that consumers stop engaging digitally because they no longer trust the process. Addressing this global issue requires a multi-layered approach, as there is no single solution to prevent fraud.”